As you will no doubt be aware, there have been changes introduced from 6 April 2020 which require reporting for tax purposes a lot earlier than normal. If you have made a taxable gain on a residential property, you are now required to report this to HMRC within 30 days of completion and pay the tax at the same time.

So the question is, how can you correctly calculate the gain arising?

In addition to these reporting requirements, the ability to claim lettings relief (should have let your home during part of the period of ownership), has been severely restricted, along with the relief which is available when selling your home, after you have moved out, which has been reduced from 18 months to 9 months.

We therefore have to consider what reliefs are still available and how best to access them. Let’s consider a couple of scenarios:

Scenario 1

James has purchased a property but it requires some renovations prior to moving in. Once completed, James moves in and lives in the property for a period of time before being required to go and work overseas on a secondment with his employer. During this time the property is left empty. On James’ return from overseas, he moves back in for a short period before being relocated for work elsewhere in the UK. James purchases a second property in this new location, into which he moves and rent out the original property. After a period of time, James decides to sell the first property and retain the second one as his main residence.

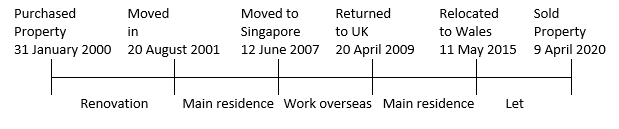

When starting to look at the Capital Gains Tax position on the disposal of any residential property where there are breaks in periods of residence, we always prepare a timeline as this gives a pictorial representation of the periods of ownership and the void periods.

As you can see from the picture below, the timeline shows that the first period was void due to the renovation. The second was a period of residence, the third was a period of void due to working overseas, then another period of residence before ending with a period of let.

There is a concession which allows for renovation works before moving into a property of up to 24 months (extended from 6 April 2020 from 12 months) to be treated as a period of residence. So this means that this first period, because James moved in after the renovations were complete, is exempt.

The period during which he was working overseas is also allowed as a period of residence under the legislation and so again this period will be exempt from Capital Gains Tax.

Finally, we look at the period of let at the end of ownership. If this period was less than 9 months, then this too would be exempt and so the whole period of ownership of the property would be exempt and no Capital Gains Tax would arise. As we can see from this chart, the final period exceeded 9 months, and so the gain would be time apportioned. A small period of chargeability would arise. Please remember that every individual has access to a Capital Gains Tax allowance of £12,300 for 2020/21.

Let’s put some figures to this.

James purchase the property in 2000 for £60,000. No stamp duty. Legal fees of £500

He spent £20,000 doing it up

It is now worth £320,000 with estimated Legal and Estate Agents fees of £10,000

The property was owned for 242 months, of which 50 are chargeable (let period less 9 months).

This gives a gain of £47,417. After allowances the taxable gain is £35,117. Assuming James is a higher rate taxpayer, tax is due at 28% – £9,833. This is payable on 8 May 2020.

Scenario 2

Our second individual, Sarah, has lived overseas for a number of years and has a home abroad. However, she has been coming back to the UK to undertake some work and so has purchased a property which she uses as her base whilst here. Irrespective of where you live in the world, you still can only have one main residence and this may be overseas. Sarah is married and has a family who live overseas in Spain. Really, the UK property is similar to having a hotel room.

In a later period, the family move to the UK property in order to take up full time residence and sell their Spanish home.

If the UK property is subsequently sold (again you would need to look at the timeline), Sarah would be entitled to the final 9 months of ownership as exempt. This is true even if Sarah and her family’s actual period of residence is less than 9 months.

The legislation states that you are entitled to the final 9 months of ownership as exempt from Capital Gains Tax if the property has been your only or main residence at some point during ownership. There is still no legal minimum period for which a property has to be your main residence but you have to be able to prove that this was your only or main home over and above any other properties owned. Obviously if this is the only property that you own, then it is more likely that this would be true.

There are other reliefs available that have not been covered in these examples. It is important to note that for these periods of absence (including where you are required to work overseas) that the property must have been your home both before and after these periods for them to be treated as exempt.

If you are in the position where you may wish to sell a residential property and want to understand the tax position, please do contact Lucy Orrow on 01376 326266 or lucy.orrow@lambert-chapman.co.uk and we can prepare relevant computations.

Disclaimer

The views expressed in this article are the personal views of the Author and other professionals may express different views. They may not be the views of Lambert Chapman LLP. The material in the article cannot and should not be considered as exhaustive. Professional advice should be sought in connection with any of the issues contained in the article and the implementation of any actions.